On March 18, President Trump signed into law the Families First Coronavirus Response Act, legislation which aims to provide economic relief for individuals, businesses, and organizations impacted by COVID-19, including Lutheran Services in America member organizations. Among its other provisions, the law provides increased federal support for Medicaid spending during the pandemic in the form of a 6.2% emergency Federal Medical Assistance Percentage (FMAP) increase to states. The FMAP is the federal portion of the total Medicaid expenditure for each state.

The law also institutes a temporary paid sick leave mandate, along with an expansion of family and medical leave provisions. Employers with fewer than 500 employees, including nonprofits, will be required to provide employees who are themselves sick or quarantining two weeks of fully paid sick leave, and 10 additional weeks of leave at two-thirds pay. Employees caring for others who are sick or children whose childcare services are closed must be paid at two-thirds of their regular pay for up to 12 weeks. Employers will be fully reimbursed for providing this leave via a refundable tax credit allowed against the employer portion of payroll taxes—thus benefitting nonprofits. Any paid leave costs that exceed the amount of payroll taxes owed will be refundable to the employer at the end of each quarter. Finally, the law suspends SNAP work requirements and provides free testing for COVID-19, $2 billion in unemployment assistance and $1 billion in food aid.

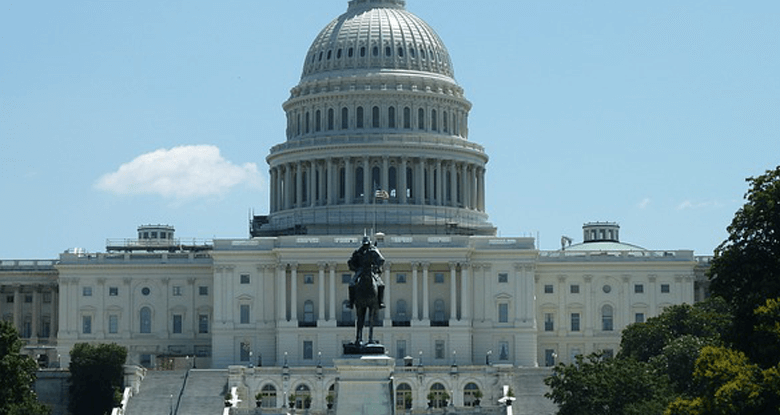

Another relief bill is currently being written in Congress, which is expected to include additional specific support for the nonprofit sector and individuals and families.